~2 Week Intensive: LIVE February 11th - 21st 2025 @ 2PM AEDT(Syd Time)

Discover the 'Hidden Growth Levers' That Have Helped Founders Scale Their Ventures by 2x, 5x and Even 10x Without More Team Members, or Raising Additional Funding

Notice: While you will NOT transform into a unicorn overnight with what you’ll learn here, you will uncover hidden opportunities that can lead to exponential returns—while keeping the same effort and input—in a way that focuses on substance and sustainability.

~2 Week Intensive: LIVE February 11th - 21st 2025 @ 2PM AEDT(Syd Time)

Discover the 'Hidden Growth Levers' That Have Helped Founders Scale Their Ventures by 2x, 5x and Even 10x Without More Team Members, or Raising Additional Funding

Notice: While you will NOT transform into a unicorn overnight with what you’ll learn here, you will uncover hidden opportunities that can lead to exponential returns—while keeping the same effort and input—in a way that focuses on substance and sustainability.

As part of the 2-week intensive and based on program completion, participants receive:

As part of the 2-week intensive and based on program completion, participants receive:

Engenesis: An Official AWS Activate Provider

As a registered AWS Activate Provider, graduates of the program who choose to proceed to work with Engenesis are able to access startup grants to cover the cost of AWS hosting services (conditions apply).

Register Now to Transform Your Start-Up into a High-Growth Venture with Engenesis

As a registered AWS Activate Provider, graduates of the program who choose to proceed to work with Engenesis are able to access startup grants to cover the cost of AWS hosting services (conditions apply).

Register Now to Transform Your Start-Up into a High-Growth Venture with Engenesis

RE: Letter from the Director

Dear Founder,

As the Director of Engenesis, I’ve worked with countless entrepreneurs, each driven by a vision to create something extraordinary.

Yet, one challenge arises time and again: founders can get stuck in the weeds and are left with overwhelming options so get stuck in transforming into a promising venture into a scalable, thriving business. This is why we created the Venture Building Start-Up Program.

This isn’t your typical startup program. Unlike theoretical frameworks and abstract concepts, the Venture Building Start-Up Program is designed for founders who are ready to act. It’s a high-impact, two-week program tailored to equip you with the tools, strategies, and insights to accelerate your venture’s growth.

Why Join the Venture Building Start-Up Program?

- Results-Oriented Approach: Our program isn’t about ideas—it’s about action. We’ll help you cut through the noise and implement proven strategies to achieve tangible outcomes.

- All-Encompassing Framework: From customer acquisition and scaling operations to investor readiness, we address every critical aspect of growth.

- Live Workshopping: Engage directly with experts who’ve been in the trenches, guiding you with tailored advice to overcome your unique challenges.

Who Is This For?

This program is built for founders like you, who are ready to move beyond the status quo and take decisive steps toward success. Specifically:

- Founding Teams with Existing Validation: You’ve validated your idea, and now it’s time to build and launch effectively.

- Ventures with Initial Customer Traction: If you’ve launched and begun gaining momentum, we’ll help you refine and scale.

- Growth-Stage Ventures: For those looking to expand operations, raise capital, or reach new markets, this is your next big move.

What You’ll Gain:

- Review your entire venture from multiple perspectives

- Identify hidden opportunities for growth and leverage

- Harness the experience of 2400+ other startups to avoid pitfalls and reduce waste

Why Engenesis?

At Engenesis, we’re not just mentors—we’re builders ourselves.

We’ve partnered with ventures across the globe and have our own portfolio, navigating the complexities of growth while delivering measurable results.

From securing funding to scaling teams, we and our founding teams have been where you are, and we know what it takes to succeed.

This is your opportunity to break free from stagnation, overcome bottlenecks, and supercharge your venture’s trajectory.

Applications Close Soon – Secure Your Spot Today

Ariya Chittasy

Director, Engenesis Ventures

RE: Letter from the Director

Dear Founder,

As the Director of Engenesis, I’ve worked with countless entrepreneurs, each driven by a vision to create something extraordinary.

Yet, one challenge arises time and again: founders can get stuck in the weeds and are left with overwhelming options so get stuck in transforming into a promising venture into a scalable, thriving business. This is why we created the Venture Building Start-Up Program.

This isn’t your typical startup program.

Unlike theoretical frameworks and abstract concepts, the Venture Building Start-Up Program is designed for founders who are ready to act.

It’s a high-impact, two-week program tailored to equip you with the tools, strategies, and insights to accelerate your venture’s growth.

Why Join the Venture Building Start-Up Program?

- Results-Oriented Approach: Our program isn’t about ideas—it’s about action. We’ll help you cut through the noise and implement proven strategies to achieve tangible outcomes.

- All-Encompassing Framework: From customer acquisition and scaling operations to investor readiness, we address every critical aspect of growth.

- Live Workshopping: Engage directly with experts who’ve been in the trenches, guiding you with tailored advice to overcome your unique challenges.

Who Is This For?

This program is built for founders like you, who are ready to move beyond the status quo and take decisive steps toward success. Specifically:

- Founding Teams with Existing Validation: You’ve validated your idea, and now it’s time to build and launch effectively.

- Ventures with Initial Customer Traction: If you’ve launched and begun gaining momentum, we’ll help you refine and scale.

- Growth-Stage Ventures: For those looking to expand operations, raise capital, or reach new markets, this is your next big move.

What You’ll Gain:

- Review your entire venture from multiple perspectives

- Identify hidden opportunities for growth and leverage

- Harness the experience of 2400+ other startups to avoid pitfalls and reduce waste

Why Engenesis?

At Engenesis, we’re not just mentors—we’re builders ourselves.

We’ve partnered with ventures across the globe and have our own portfolio, navigating the complexities of growth while delivering measurable results.

From securing funding to scaling teams, we and our founding teams have been where you are, and we know what it takes to succeed.

This is your opportunity to break free from stagnation, overcome bottlenecks, and supercharge your venture’s trajectory.

Applications Close Soon – Secure Your Spot Today

Ariya Chittasy

Director, Engenesis Ventures

We're on a mission to scout the world's top founders early, forging partnerships that fuel scalable success.

Lock in your place now.

Plus, keep your equity - participation comes with no equity grab attached.

Lock in your place now.

Plus, keep your equity - participation comes with no equity grab attached.

What other founders are saying

What other founders are saying

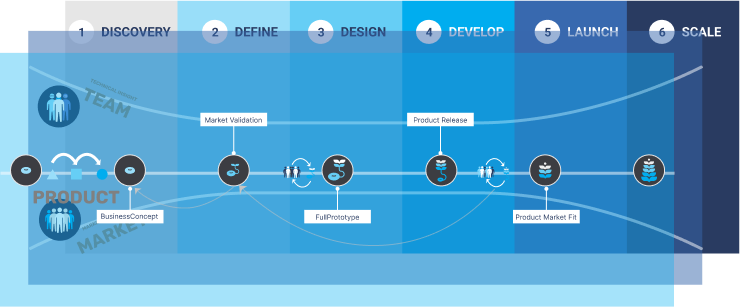

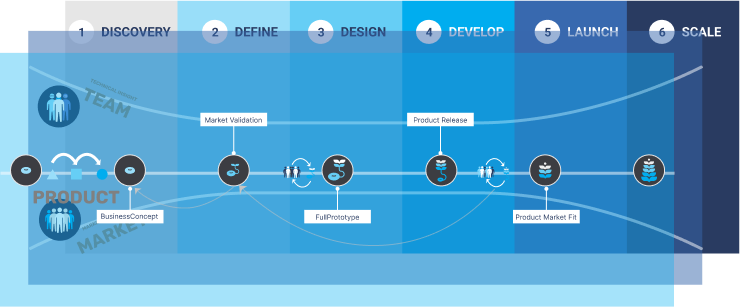

Leverage Thousands of Hours of Experience in One Unique Framework

Founders often say that the VBSU Program gives a far more structured, rigorous and well-rounded approach to effectively growing their startup.

In the Program, you will be introduced to an original and unique framework based on years of experience with thousands of startups, collated in what is called the Genesis Framework™.

Rather than making expensive mistakes themselves, the founders who go through the VBSU program fast-track their growth by avoiding the pitfalls that get in the way of most teams' growth.

Leverage Thousands of Hours of Experience in One Unique Framework

Founders often say that the VBSU Program gives a far more structured, rigorous and well-rounded approach to effectively growing their startup.

In the Program, you will be introduced to an original and unique framework based on years of experience with thousands of startups, collated in what is called the Genesis Framework™.

Rather than making expensive mistakes themselves, the founders who go through the VBSU program fast-track their growth by avoiding the pitfalls that get in the way of most teams' growth.

What does the Venture Building Start-Up Program consist of?

What does the Venture Building Start-Up Program consist of?

Join VBSU Program and Take Your Startup to the Next Level

During the first session, we dive into the needs of your ideal customer by analysing their experience based on the dissonance and tension between their optimal and non-optimal states. This helps determine how your company can address burning pains in the market. By shifting from solely being product-focused to being customer-centric, you can gain a clearer view of how to meet your customers' needs.

Also we dive into key areas such as the company viability formula, customer acquisition cost, and the revenue by customers chart. We provide a clearer roadmap on what goes into building high-scale companies.

In session 3, we share what is required to build tech that scales globally. There is a certain approach that founders require from day one. In addition, we look at how you need to BE as an entrepreneur to build a large scale business.

Also we give you the insider view on what investors think so that you can stop yourself from being disqualified in the first meeting (what happens to most founders). We'll introduce you to the paradigm of how to approach investment to be effective at it.

During the first session, we dive into the needs of your ideal customer by analysing their experience based on the dissonance and tension between their optimal and non-optimal states. This helps determine how your company can address burning pains in the market. By shifting from solely being product-focused to being customer-centric, you can gain a clearer view of how to meet your customers' needs.

Also we dive into key areas such as the company viability formula, customer acquisition cost, and the revenue by customers chart. We provide a clearer roadmap on what goes into building high-scale companies.

In session 3, we share what is required to build tech that scales globally. There is a certain approach that founders require from day one. In addition, we look at how you need to BE as an entrepreneur to build a large scale business.

Also we give you the insider view on what investors think so that you can stop yourself from being disqualified in the first meeting (what happens to most founders). We'll introduce you to the paradigm of how to approach investment to be effective at it.

Register Now to Transform Your Start-Up into a High-Growth Venture with Engenesis

$0-$800m

Size of revenues we’ve worked with

2400+

Number of companies we’ve interviewed or studied to build our frameworks.

800+

Number of companies our team has had experience directly working with

31+

Number of countries we’ve worked in

BY THE NUMBERS

BY THE NUMBERS

$0-$800m

Size of revenues we’ve worked with

2400+

Number of companies we’ve interviewed or studied to build our frameworks.

800+

Number of companies our team has had experience directly working with

31+

Number of countries we’ve worked in

Frequently Asked Questions

Q: Do I need to give up equity to join the program?

No, joining the VBSU program does not require giving up equity in your startup. However, follow-up conversations may involve an equity exchange, which would be separate from your participation in the program.

Q: Is Engenesis a venture capital firm?

No, Engenesis takes a venture-building or parallel entrepreneurship approach.

Q: Is there a demo day?

No, there is no demo day in this program.

Q: Will I receive investment if I complete this program?

Completing the program does not guarantee investment. However, the program covers material that has helped other founders successfully raise funds from investors.

Q: Will I have the opportunity to be connected with investors as part of this program?

Participants of the VBSU program are not guaranteed connections to investors within the Engenesis network upon program completion. However, we do have an active network of investors who we may connect with startups we have relationships with after the program.

Frequently Asked Questions

No, joining the VBSU program does not require giving up equity in your startup. However, follow-up conversations may involve an equity exchange, which would be separate from your participation in the program.

No, Engenesis takes a venture-building or parallel entrepreneurship approach.

No, there is no demo day in this program.

Completing the program does not guarantee investment. However, the program covers material that has helped other founders successfully raise funds from investors.

Participants of the VBSU program are not guaranteed connections to investors within the Engenesis network upon program completion. However, we do have an active network of investors who we may connect with startups we have relationships with after the program.

Next Cohort Dates

📆Session 01: Tuesday, 2024-February-11th, from 2:00-3:30 PM (Sydney Time, AEDT)

📆Session 02: Friday, 2024-February-14th, from 2:00-3:30 PM (Sydney Time, AEDT)

📆Session 03: Tuesday, 2024-February-18th, from 2:00-3:30 PM (Sydney Time, AEDT)

📆Session 04: Friday, 2024-February-21st, from 2:00-3:30 PM (Sydney Time, AEDT)

Forget the $999 fee

Lock in your place now for just $97 USD.

Plus, keep your equity - participation comes with no equity grab attached.

We take privacy seriously, you can check out our privacy policy.

We take privacy seriously, you can check out our privacy policy.